People lose, government wins in income tax decision

Note: The following e-newsletter was sent to Sen. Wilson’s subscribers March 29, 2023. To subscribe to Sen. Wilson’s e-newsletters, click here.

Dear friends and neighbors,

In this e-newsletter, I’m going to tell you about the most shocking development in Washington politics since I-don’t-know-when. It’s not that anyone was surprised when the state Supreme Court ruled in favor of the income tax last week.

In this e-newsletter, I’m going to tell you about the most shocking development in Washington politics since I-don’t-know-when. It’s not that anyone was surprised when the state Supreme Court ruled in favor of the income tax last week.

After all, an income tax is a top priority for legislative Democrats, and most justices are appointed by the governor.

The shocking part was that this high-priced legal talent did such a wretched job of covering for itself.

The court ruled 7-2 that a tax on capital gains income is an “excise tax,” not an income tax — even though the rest of the world says it is. This remarkable decision ignored legal principles, longstanding precedents, our common national understanding of tax law, and even Webster’s Dictionary. It cited political opinions rather than legal arguments. The opinion was so poorly reasoned that the court did considerable damage to its reputation and moral authority. Never again will the court be seen as a neutral arbiter of law.

In other news, we are at the point of our 2023 legislative session where we are debating budgets and wrapping up the details on major pieces of legislation. I have good news to report on capital construction projects for southwest Washington, and legislation I have sponsored to combat catalytic converter theft and promote roadside safety. Read on for more.

Sen. Jeff Wilson, 19th Legislative District

Town hall meetings in Longview and Aberdeen

The state Supreme Court has given us a terrific example of the way government shouldn’t work, but we got a more positive lesson at a pair of town hall meetings in Longview March 11 (above) and Aberdeen March 25. We drew large crowds at both events, and it was a pleasure talking one-on-one about the issues before us in Olympia. Events like these show the value of straight talk, honest conversation, and being able to look people in the eye. Thanks to Rep. Jim Walsh for joining us, and thanks to everyone who attended!

Surprise! Washington state now has an income tax

Olympia pulls a fast one on the people of Washington, and state Supreme Court plays along

It should be clear by now where the people of Washington stand on the income tax. They have voted against it 11 times since 1934. The last time the people were asked in a straightforward way, in 2010, they were 64 percent opposed. Supporters keep trying to tell them an income tax would be good for them, but the people are smarter than that. They know an income tax would quickly become a tool to extract more money from the people of the state.

Two years ago, advocates of higher taxes and spending finally gave up trying to convince the people. Instead, Democratic legislators cut the people out of the loop, by passing an income tax bill in the Legislature without sending it to the people for a vote. Even worse, they included an “emergency clause,” to prevent anyone from filing a referendum to overturn it. Every Republican in the House and Senate voted against this bill, including me, but our colleagues had the votes to pass it.

Now they have won the initial battle. The state Supreme Court’s poorly reasoned opinion allows this new tax on capital gains income and opens the door to an even bigger one that will hit people statewide. Anyone who thinks this tax will stay small and will only hurt the rich hasn’t been paying attention to history. Big broad-based income taxes always start like this one, as we have seen on the national level and in state after state. Eventually government will come for the middle class, because that’s where the money is. Another Supreme Court decision will be required in order to extend this tax to all of us, but after this last ruling, no one should feel safe.

To approve this tax on capital gains income, the justices had to stand on their heads and read the dictionary sideways. They declared this income tax to be an excise tax, a decision that baffles tax experts and runs contrary to interpretations in every other state and from the IRS. It contradicts a decision made by our own state Supreme Court on this very issue in 1937, when it was more interested in persnickety matters of legal precedent and constitutional interpretation. Especially disturbing is the decision’s use of political sloganeering. One example: It claims our tax code “perpetuates systemic racism,” as if that political claim has any legal meaning or basis in fact.

From 1933 until last week, our court took the position that an income tax required a constitutional amendment, meaning votes of the Legislature and the people were needed. Now it has found an excuse to cut the people out of the decision. When the court released its ruling Friday, it was a dark day for democracy and a betrayal of the people of Washington. This affair demonstrates a growing problem in our government, the tendency of elected officials, bureaucrats and judges to ignore the people when they are inconvenient. Government should be of the people, not over the people.

Important legislation advances

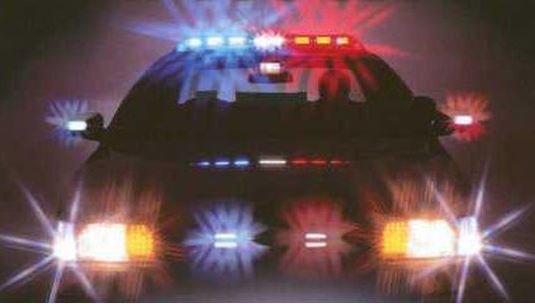

Catalytic Converter Theft – SB 5740, my bill to crack down on catalytic converter theft, has cleared the Senate Law and Justice committee. This bill remains in play during the Legislature’s final weeks, and I’ll have more to say when the dust settles. This measure appears to have an excellent chance of passage this year.

Roadside/Tow-Truck Safety – SB 5023 was prompted by the tragic deaths of tow truck operators and motorists along I-5 in southwest Washington. The measure allows tow-truck operators to use rear-facing red-and-blue flashers at highway emergency zones. The bill passed the House Friday and now awaits action by the governor.

Capital budget includes $40M vocational building at Lower Columbia College, funding for local projects

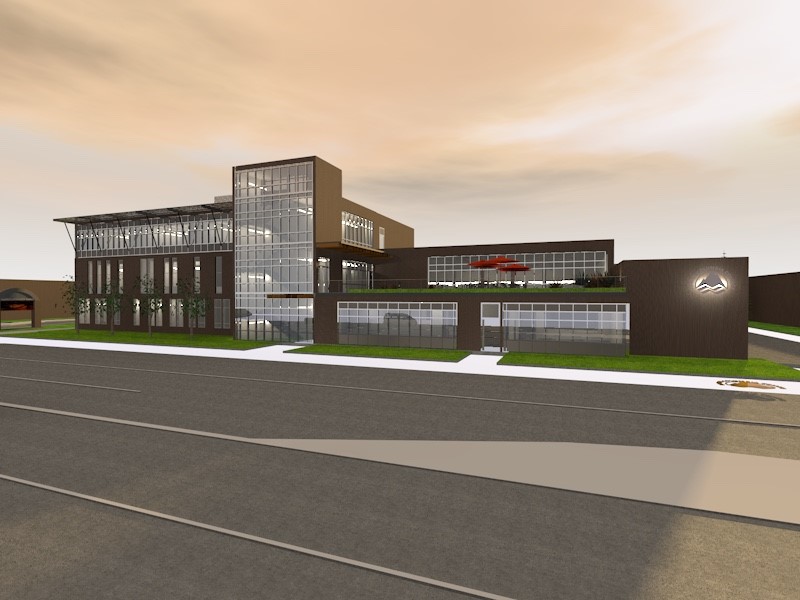

Lower Columbia College Center for Vocational and Transitional Studies, Longview.

Lower Columbia College Center for Vocational and Transitional Studies, Longview.

The Washington Senate Friday passed a capital budget providing $40 million for a new vocational training center at Lower Columbia College in Longview, $8.3 million for improvements to Cape Disappointment State Park, and other public works projects across southwest Washington.

The new 46,000 square-foot building will replace four aging structures on the community college campus, and will house the school’s welding, machining, manufacturing, information technology and computer science programs. It also will house College and Career Preparation program offices.

The new building is among $125 million in projects for the 19th Legislative District contained in the Senate version of the capital budget, one of three major budget bills Washington lawmakers will pass this year. Senate Bill 5200 passed the Senate Friday 44-0 and has moved to the House for further consideration. Lawmakers also must pass operating and transportation budgets before their scheduled adjournment April 23.

“Lower Columbia College is a centerpiece for Southwest Washington, providing educational opportunities for the surrounding region, and it’s great to get the funding in the capital budget,” Wilson said. “We also were able to obtain funding for a number of other local projects important to our communities and state.”

For Lower Columbia College, the budget also includes $1.3 million for improvements to David Story Field, home of the Cowlitz County Black Bears semi-pro baseball team.

Cape Disappointment State Park allocations include $4.8 million for improvements to the park entrance and welcome center, $3.1 million for campground renovations, and $388,000 for improvements to Three Waters Trail.

Other major recreational facility investments include the Willapa Hills Trail, a railbed converted to trail use that remains in need of repair. The budget provides $2.6 million for surfacing and $125,000 for trailhead facilities.

Wilson said he worked with Sen. John Braun, R-Centralia, to obtain an amendment on the Senate floor providing $2.5 million for the Lewis County Homeless Shelter in Chehalis. The facility, supported by local elected officials and community members, provides services to the homeless regionally.

Other projects funded by the budget include:

- Beaver Creek Hatchery renovation, $2.7 million.

- Castle Rock, North County Recreational Association Youth Sports, $256,000.

- Cathlamet Skate Park, $96,000.

- Cathlamet Waterfront Park, $86,000.

- Long Beach wastewater treatment system upgrades, $330,000.

- Longview, Cloney Inclusive Playground, $1 million.

- Longview library capital improvements, $750,000.

- Longview Youth Emergency Shelter, $330,000.

- McCleary, Museum and Heritage Center preservation, $74,000.

- Montesano, Grays Harbor County Courthouse renovation, $225,000.

- Naselle Hatchery renovation, $11.5 million.

- Ocean Park, Peninsula Senior Activity, $264,000.

- Pe Ell, Lester Creek drinking water intake, $640,000.

- South Bend library capital improvements, $673,000.

- South Bend, Madison Street School Sidewalk Project, $175,000.

- Westport Skate Park and Pumptrack, $500,000.

Contact me!

Telephone: (360) 786-7636

Email: Jeff.Wilson@leg.wa.gov

Mailing address: P.O. Box 40419 /Olympia, WA 98504

Leave a message on the Legislative Hotline: 1-800-562-6000

To unsubscribe from these regular updates from Olympia, go to the Subscriber Preferences Page below.