Note: The following e-newsletter was sent to Sen. Jeff Wilson’s subscribers May 9, 2025. To subscribe to Sen. Wilson’s e-newsletters, click here.

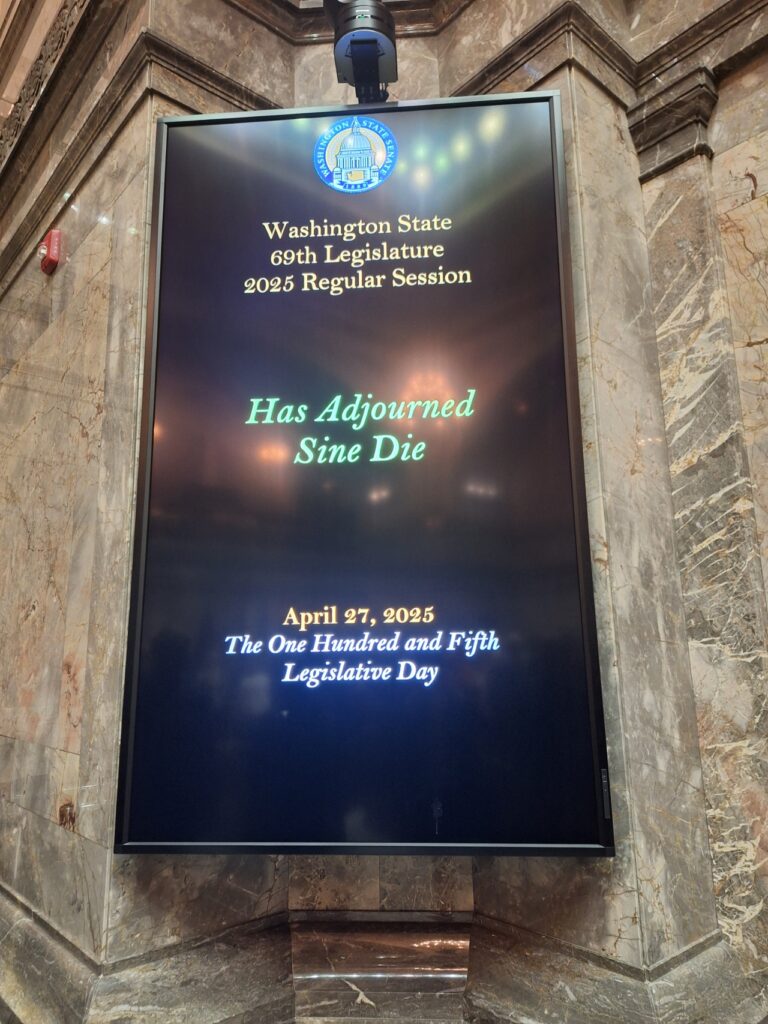

We adjourned our session April 27, and maybe the best thing we can say about it is that it is done. Now let’s hope the governor calls us back for a do-over.

Dear Friends and Neighbors,

Our 2025 legislative session is over, but Washington state will be living with the consequences for years to come. This year our majority colleagues passed the biggest tax increase in state history, along with legislation to increase the power of state government at the expense of the people.

Technically, we’re not done yet. We’re still waiting to see if the governor will use his veto authority to rein in taxes and spending — or maybe even call us back into session and tell us to start over. Without major course corrections, however, you and I and everybody else in Washington state will be on the hook for some of the most irresponsible budgeting ever seen at the statehouse.

By 2028, this year’s tax increases will be the equivalent of a $2,300 annual tax on the average Washington family.

There were a few bright spots this year, including passage of a bill I sponsored to study the “forever chemical” problem and a capital budget that will fund needed public infrastructure projects across southwest Washington and the entire state. But I am afraid these successes were overshadowed by this year’s unneeded tax hikes and troubling legislation.

Budget crisis was Legislature’s fault

This was the eighth session since Democrats took full control of the Legislature, and the fourth consecutive budget that spends more than we have. Expenditures doubled over the last decade as our colleagues broke every rule of sound budgeting to drive spending to the max. They used one-time money to launch permanent programs, they relied on projections everyone knew were unrealistic, and they even invented a new accounting dodge to reduce required deposits to the state Rainy-Day fund. This year these bad habits finally caught up with them.

We had enough money to meet our state’s basic needs without a tax increase, but we were about $7 billion short of paying for all the new spending our friends had authorized in previous years. And still they wanted to spend more.

Most of us would see this as a reason to change our plans. Majority Democrats saw it as an excuse for a staggering tax increase totaling $12.5 billion at the state and local levels over the next four years.

Well-wishers swarmed the Senate floor April 27 when final gavels fell to end the 2025 legislative session.

Biggest and most unnecessary

This year’s tax increase is the biggest-ever in dollar terms. Percentage-wise, it is the biggest increase in 44 years. Contrary to our colleagues’ claims that they are targeting the rich, this hodge-podge of taxes and fees punishes everyone in the state, from higher license fees for hunters and fishers to higher business taxes that will be passed on to consumers. But the most disturbing thing is that this budget does nothing to address the real problem. State spending continues to skyrocket, meaning we will find ourselves in trouble again the next time we hit a bump in the road.

Our side worked with the same numbers and found something remarkable. We could balance our budget without new taxes and avoid harmful cuts if we just avoided new spending. We wrote a budget bill to prove it. But our friends were stuck on taxes and they had the votes.

Another 50 cents a gallon

Let’s also note that this year’s Legislature passed a six-cent-a-gallon gas-tax increase with a new feature, automatic annual increases. Our colleagues also passed a bill ratcheting up the requirements of our state’s unworkable low-carbon fuel standards law. The combined effect of these two pieces of legislation will be about 50 cents a gallon by 2028, on top of Washington’s already-high gas prices.

Left turn on policy

Democrats broadened their majorities last election to the point they had “supermajorities” in the House and Senate. With 60 percent of the vote in both chambers, they could pass nearly anything they wanted. They took advantage of the opportunity to pass a sharply partisan ideological agenda. Some of their proposals died due to public hostility, like a plan to allow property taxes to increase at three times the current rate – 43,680 people registered their opposition, an all-time record. But what passed was bad enough.

• Gutting the people’s initiative on parental rights in the public schools, and increasing Olympia’s ability to dictate to local school districts on curriculum and transgender participation in girls’ sports (HB 1296),

• Unemployment benefits for striking workers, giving unions the upper hand in labor negotiations and an incentive to manufacturers to locate anywhere but Washington (SB 5041),

• More power for health officials in the next pandemic, with a bill written so broadly and vaguely that it should make all of us nervous (HB 1531),

• Infringing on Second Amendment rights with a “permit to purchase” bill requiring completion of a gun-safety course before a firearm can be purchased, thus placing a condition on the exercise of a right guaranteed by the state and federal constitutions (HB 1163),

• Expanding the state’s taxpayer-funded “reparations” program, which provides low-interest loans for home purchases to people of certain races and ethnic backgrounds while excluding others, a probable violation of the 14th Amendment to the U.S. Constitution, should anyone choose to sue (HB 1696),

• Doubling down on Washington’s shortage of affordable housing by imposing rent control, which will eliminate any incentive to build new rental units, and give landlords an incentive to sell rental properties (HB 1217),

• And many, many more.

Forever chemical’ bill is bright spot

And now some good news. Three bills I introduced this year have gone to the governor, and one already has been signed into law. The bill with the most far-reaching consequences is SB 5033, launching a sampling program for “forever chemicals” in our food supply.

This bill reflects the fast-rising concern with PFAS compounds, short for perfluoralkyl and polyfuoralkyl. These compounds, used in carpets, firefighting foam, nonstick cookware, and other applications, do not readily break down in the environment, and can concentrate in the human body. One major worry is potential contamination of our food supply when human waste is used as fertilizer. This bill requires the state Department of Ecology to establish a testing program for PFAS contamination in “biosolids,” and report findings to the Legislature by 2030.

The governor is expected to take action on this bill soon. Other bills are:

• SB 5049, giving the state Public Records Exemptions Accountability Committee more flexibility in scheduling meetings. The measure is among proposals from Wilson to improve the effectiveness of the “Sunshine Committee,” which advises the Legislature on public records issues. Signed into law.

• SB 5365, clarifying that public libraries can be included in community centers and funded by parks and recreation districts, eliminating a concern for the city of Castle Rock. Awaits governor’s signature.

Biosolid fertilizers applied to a pumpkin field./ CC-by-3.0/ Red58Bill

Local projects win funding

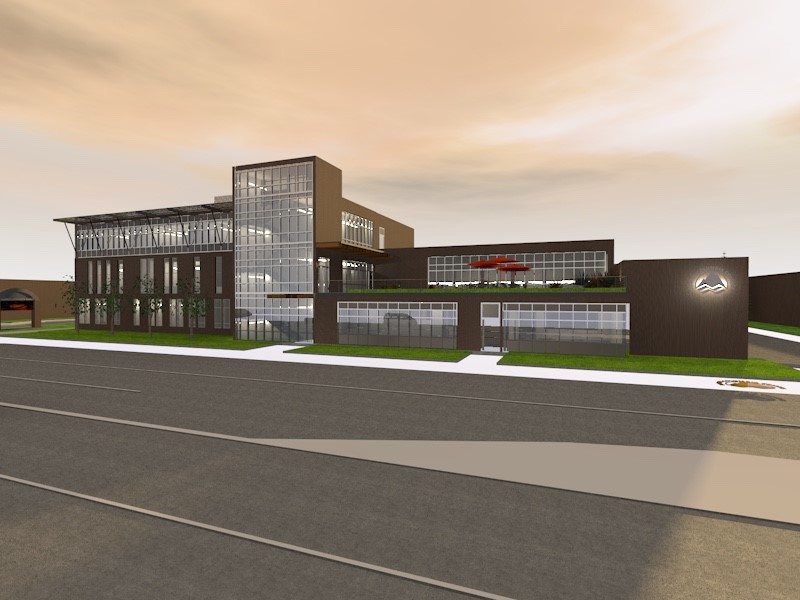

Another bright spot this year was passage of a $7.6 billion capital budget that did a good job of distributing public-works projects statewide. Let me point out that these infrastructure projects are funded primarily by bonds and are not directly affected by the tax increases in the operating budget. Projects for the 19th District include:

• Longview – Center for Vocational and Transitional Studies, $45 million. This long-sought project replaces outdated campus buildings with new classrooms and computer-lab and vocational education space.

• Kelso – Public Housing/Community Center/Library, $1.5 million. This appropriation will help build a 40-unit low-income housing project on city-owned property at the intersection of Catlin Street and Second Avenue SW, and will replace the city’s aging community center and library. Total cost of the project is $18 million.

• Grayland – New South Beach Area Maintenance and Administration facility, Grayland Beach State Park, $1.3 million – replaces partially shuttered flood-prone facility at Twin Harbors State Park.

• Longview – Columbia Theater Centennial Capital Project, $1 million. Part of a $3.5 renovation project, money will pay for restoration and up-to-date audio/visual and lighting equipment.

• Raymond – Veterans’ Housing and Resource Center, $950,000. Money will help the Willapa Community Development Association demolish the existing American Legion building and replace it with public housing and a community center; a new city hall also is planned. Total cost of the project is $15.9 million.

• Aberdeen – Lady Washington restoration, $688,000 and building demolition at Seaport Landing, $150,000. Money will help realize the vision of a waterfront maritime heritage center with the Lady Washington, the state’s official ship, as the centerpiece.

• Port of Chinook – Dredge Acquisition, $515,000. Pays for a new dredge to help maintain and expand the 300-slip Chinook Marina. The marina is a hub for commercial and sports fishing and is critical to the local economy.

• Castle Rock – Impound/Storage Facility, $370,000 – Builds a secure police impound yard with fire-resistant storage for electric vehicles.

• Cathlamet – Wahkiakum County Courthouse renovation, $365,000.

• Longview – Library Elevator Repair, $300,000.

• South Bend — Willapa Harbor Hospital replacement, $285,000.

• Tokeland – Tokeland Hotel foundation repairs, $261,000.

• McCleary — Beerbower Park athletic field improvements, $253,000.

• Cathlamet — Julia Butler Hansen House restoration and repairs, $115,000.

• Curtis – New roof for Baw Faw Grange Hall, $12,000.

Center for Vocational and Transitional Studies, Lower Columbia College in Longview.

Our session is over, but I represent you year-round. If you have a comment or concern regarding state government, I want to hear from you. Stay in touch! You can reach me with the contact information below.

Thanks for reading!

Sen. Jeff Wilson

19th Legislative District

Contact me!

Email: Jeff.Wilson@leg.wa.gov

Mailing address: P.O. Box 40419 /Olympia, WA 98504

Leave a message on the Legislative Hotline: 1-800-562-6000

Take our survey: Let us know what you think at http://www.JWilsonSurvey.com

To unsubscribe from these regular updates from Olympia, go to the Subscriber Preferences Page below.