Note: The following e-newsletter was sent to Sen. Jeff Wilson’s subscribers April 18, 2025. To subscribe to Sen. Wilson’s e-newsletters, click here.

Two ways to celebrate Tax Day: Legislative Democrats picked April 15 to release their new proposal for the biggest tax increase ever. The people found another way to mark the occasion – by staging a protest on the Capitol steps.

Dear Friends and Neighbors,

I often say there is a disconnect between the Legislature and the people of the state of Washington. But it was never more obvious than on Tuesday, April 15. This is a day most of us dread, because it is the day we are required to pay our federal income taxes. Yet our counterparts in the House and Senate Democratic majorities chose this day to release their latest proposal for the biggest tax increase in the history of the state of Washington.

I often say there is a disconnect between the Legislature and the people of the state of Washington. But it was never more obvious than on Tuesday, April 15. This is a day most of us dread, because it is the day we are required to pay our federal income taxes. Yet our counterparts in the House and Senate Democratic majorities chose this day to release their latest proposal for the biggest tax increase in the history of the state of Washington.

Honestly, I’m not sure they were even aware. As far as our majority colleagues are concerned, every day seems to be a good day for new taxes. Nor do our friends seem especially concerned what the rest of us think.

We are nine days away from the scheduled adjournment of our 2025 legislative session, and the biggest votes of the year are still to come. But already I can tell you this is shaping up as the worst session ever – for fiscal irresponsibility, extremist political ideology, disdain for public opinion, and obliviousness to the challenges the people of Washington face every day. In this newsletter, I want to tell you about the big-picture issues we are debating in Olympia as we approach the finish.

The biggest tax increase in Washington history

All told, our colleagues are proposing $18.4 billion in new and higher taxes over the next four years, at the state and local levels. This is the biggest tax increase ever, in actual dollars, as a percentage of the budget – by any yardstick.

Keep in mind, state spending has doubled over the last decade, most of it since our colleagues took control of the Legislature in 2018. They ignored warnings and utilized notorious accounting tricks to goose spending to the max. Inevitably this recklessness caught up with them, giving us a paper deficit of $7 billion this year. It’s not that we are in actual financial trouble. We have plenty of money coming in, $4.5 billion more than the last budget. But it would take another $7 billion to pay for all the new spending our colleagues authorized in previous years.

And now that we can see the consequences of this irresponsible spending, our friends don’t want to change course. They want to keep right on doing it. They think Washington taxpayers should pick up the tab, with higher taxes that would mostly linger on the books forever.

Our side worked with the same numbers and found something remarkable. We can avoid big new tax increases and harmful cuts if we just avoid new non-emergency spending. We don’t need new taxes at all. You can see our proposal here. This crisis, if we can call it that, is entirely artificial.

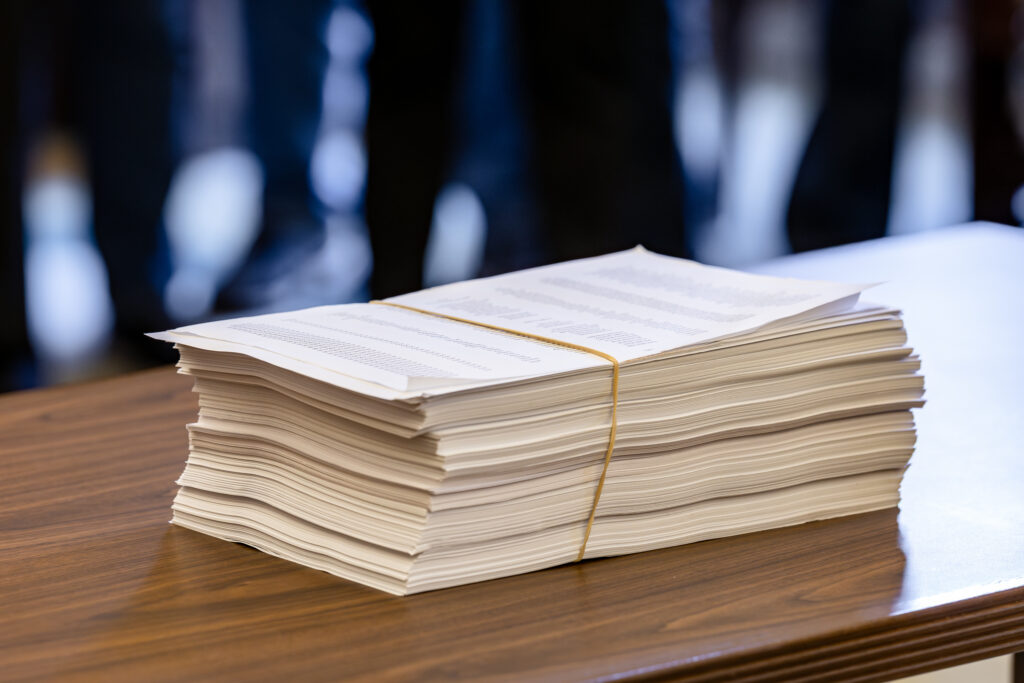

43,680 people registered their opposition to a Senate proposal for property tax increases when it came up for a hearing two weeks ago, an all-time record. This is what these electronic signatures look like when printed out. This outpouring of public opposition has done nothing to shake Democratic support for this ‘progressive tax policy’ that threatens to tax people out of their own homes.

What’s in the tax package?

Skyrocketing property taxes (SB 5812) — Democrats want to repeal a limit on property tax increases and allow them to increase at three times the current rate. This is a tax all of us would pay, rich and poor, owners AND renters. Because of compounding, after a few years, this would really add up. After 10 years, this could be a $6 billion increase, and it would just keep rising. This proposal is designed to satisfy the demands of local governments. It also would allow the Legislature to shunt more responsibilities to the local level, thus freeing up state tax collections for additional new spending. This would be especially hard on retirees living on fixed incomes, and it raises the prospect that some people will be taxed out of their own homes. Washington already has high housing costs, and this would make housing even more unaffordable.

Expanded sales taxes (SB 5814) – This proposal would extend the sales tax to service businesses currently exempt from the tax, including information technology, data processing, temporary staffing, security services and advertising. Especially troubling is a requirement that businesses pay their July 2027 taxes in June, an accounting trick that moves receipts into the current biennium. The same type of gimmick, known as “the 25th month,” was tried in this state in 1971, and for the next 16 years it reduced the state’s credit rating and cost taxpayers millions of dollars in increased borrowing costs, until lawmakers found the money to correct the problem.

Higher business and occupations taxes (SB 5815) – Most businesses would pay higher taxes on their gross receipts, with substantially higher rates for financial institutions, advanced computing and business investment income.

Higher capital gains and estate taxes (SB 5813) – These taxes would apply mainly to those of high incomes, but it is important to note that Washington would have the fifth highest capital gains tax in the country, giving job creators an incentive to do business anywhere but here.

Tesla tax (SB 5811) – Let’s give our Democratic colleagues credit for creative retribution. They figured out a way to write an electric vehicle tax bill in such a way that it applies only to Tesla. Over four years, Elon Musk’s firm would be singled out for $280 million in new taxes.

Other tax proposals also are being floated, including wealth taxes, payroll taxes, higher fees for hunting and fishing licenses, costlier liquor licenses, higher fees for Discover Passes providing access to state parks – and many more.

What’s this for?

This is the part I think will really raise hackles. Our friends want to raise taxes for things that just don’t make sense in tight budget times. Like $4 billion in raises for state employees. And taxpayer-financed showdowns with the feds on matters of partisan ideology, like immigration policy and transgender participation in women’s sports. One bill already sent to the governor’s desk expands a state “reparations” program to provide grants of public funds for mortgage down payments and closing costs. These gifts of taxpayer money would be made available only to people of certain races. This would be offensive even if our finances were sound, but at a moment like this, taxing the people to promote racial discrimination is an outrage.

But wait, there’s more

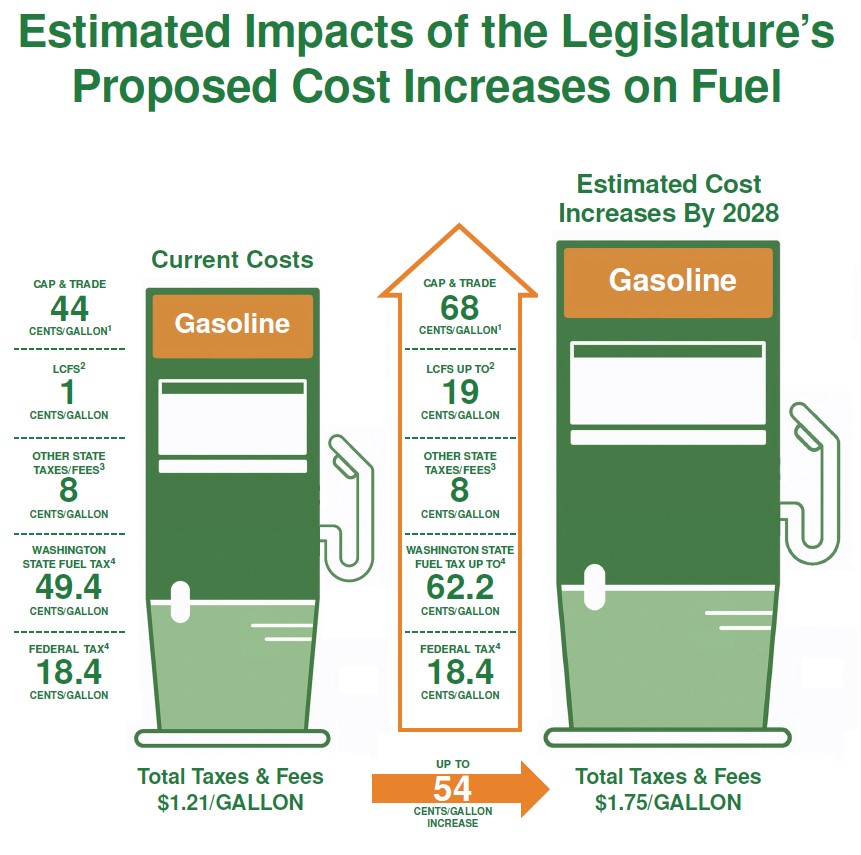

Other ideologically tinged bills this year are too many to list, from efforts to infringe on Second Amendment rights to assaults on initiatives from the people. Let me point out that in this final week we will be debating a measure to ratchet up the cost of our state’s unworkable low-carbon fuel standards program, as well as a proposal for higher gas taxes. Our gas prices are already among the highest in the country. These new taxes and fees would add 54 cents to the cost of a gallon of gas by 2028 and would keep on rising in the future.

Special session: Our best hope?

On my side of the aisle, we are really passengers on this train. As we hurtle toward disaster, we are doing our best to build coalitions with fiscally responsible members of the majority party. Unfortunately, there don’t seem to be enough of us to stop this train, and our best hope is a derailment.

Gov. Bob Ferguson has made no secret of his dismay with his own party’s irresponsible budgeting practices. A budget veto would force us into a special session, and it would require our colleagues to come up with a more thoughtful proposal. I never thought it would come to this, but Washington’s last and best hope may lie with one of the most liberal governors the state has ever elected. Ferguson has surprised us with his independence, but this is a mighty slim reed for the people of Washington to cling to. Now you know why I am calling this the worst session ever.

Thanks for reading!

Sen. Jeff Wilson

19th Legislative District

Contact me!

Email: Jeff.Wilson@leg.wa.gov

Mailing address: P.O. Box 40419 /Olympia, WA 98504

Leave a message on the Legislative Hotline: 1-800-562-6000

Take our survey: Let us know what you think at http://www.JWilsonSurvey.com

To unsubscribe from these regular updates from Olympia, go to the Subscriber Preferences Page below.